It makes my head spins sometimes trying to figure out where the market is moving to each month. I understand the big picture, I keep on trying to explain to others how Real Estate is a long term view investment and how if you look at it long term it’s a pretty low risk investment with plenty of up-side.

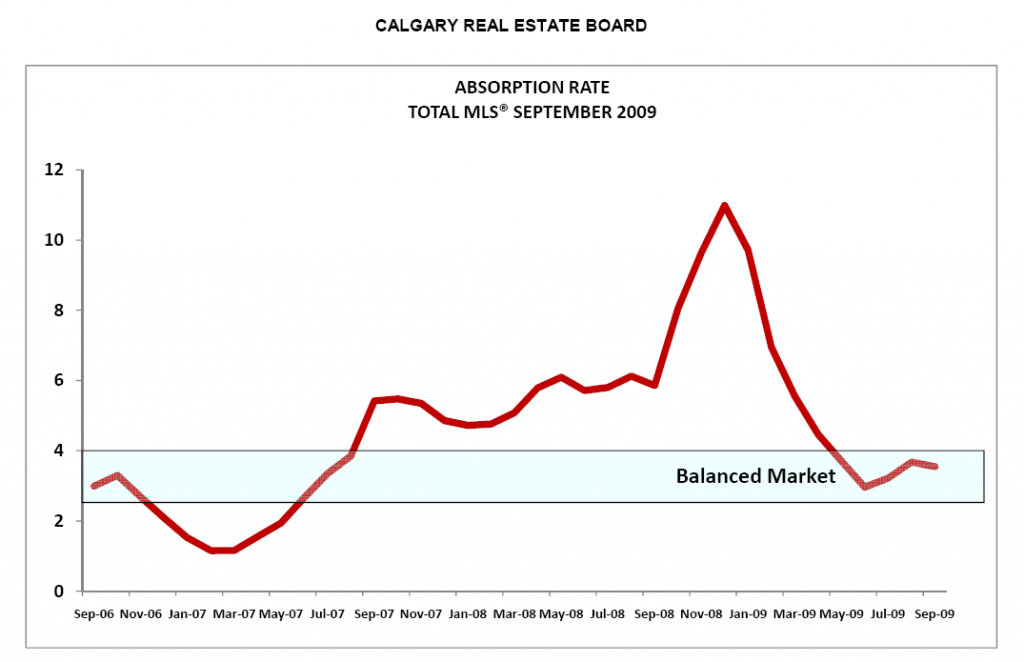

It’s the way it keeps moving each month that I have some problems with. After the last couple of years with huge excess inventory buyers have been having a great time, but now take a look at this graph out of the latest CREB statistics for September.

We have been coasting along in a balanced market since about May this year. That’s four months of what could be termed a strong healthy Real Estate market. How could that be? I keep on hearing how bad things are here. I keep hearing how it’s a bubble from all these people commenting on Real Estate articles in the Calgary Herald site. Could those people be wrong and things are actually pretty good here in Calgary, and in Alberta, like I keep telling people?

People are so used to looking at their own little microcosm of the world that they miss the big picture view. We have become so spoiled for so long we neglect to remind ourselves of where we would be if the huge economic growth hadn’t of occurred here. We forget to be thankful of what we have, and not of what we want or are not able to get.

On one hand we have many individuals in horrible situations where they may lose their homes due to layoffs, over leveraging and economic pressures. Yet at the same time many of these people would not be living in the nice homes they are currently in if the economy hadn’t blossomed so much in the middle of the decade.

I don’t want to get too excited here, things look fairly rosey right now, but we know as we get deeper into the fall, the Real Estate market will tail off again. It will slow down significantly during November and more in December, but January and then February and then spring are coming up soon. And when they arrive, we will be starting those months off with lower inventory and higher expectations than we have seen in a couple years.

It may make for a very exciting 2010!